How it works

How does shared ownership work?

- You buy a share of the property (between 10% and 75% depending on what you can afford). You will pay a mortgage on the share that you own.

- You pay rent to your Landlord on the remaining share.

- Depending on your property you may also need to pay a monthly service charge, buildings Insurance, heating and hot water charges, and/or a management charge.

EXAMPLES:

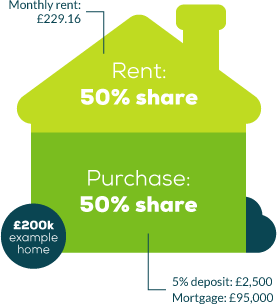

Example 1

You are buying a 50% share in a home worth £200,000.

You will need a mortgage and deposit of £100,000.

You would pay a rent on the 50% which you do not own.

- Deposit = £5,000

- Mortgage = £95,000

- Monthly Rent = £229.16

Note: Excludes building insurance and assumes no estates charge applies.

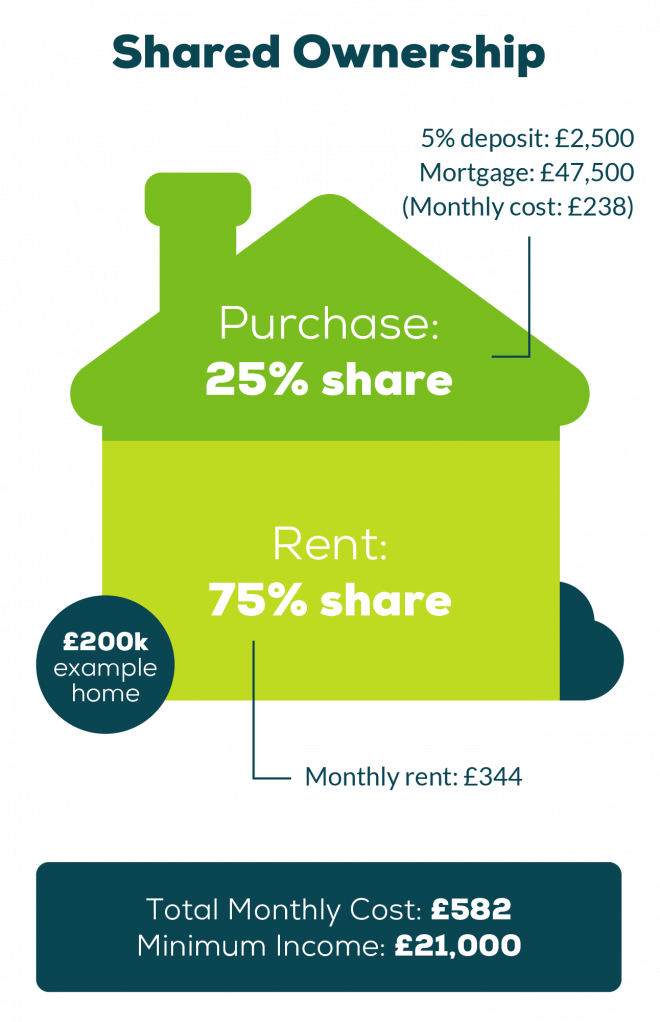

Example 2

You are buying a 25% share in a home worth £200,000.

You will need a mortgage and deposit of £50,000.

You would pay a rent on the 75% share which you do not own.

- Deposit = £2,500

- Mortgage = £47,500

- Monthly Rent = £238

Note: Example assumes a 3.5% interest rate over a 25 year mortgage term

Excludes building insurance and estates charge where applicable.